Reflecting on 2023, the national real estate market faced one of its toughest years. Skyrocketing mortgage rates, persistent inflation, and stubbornly high housing and rental prices led to the continued declining trends from late 2022. The usual spring buying season was diminished by record-low inventory and historic sales fell dramatically. Particularly telling was the state of younger buyers, where nearly 40% needed family help for down payments. Low supply and low demand kept home prices high despite the decreased number of home sales.

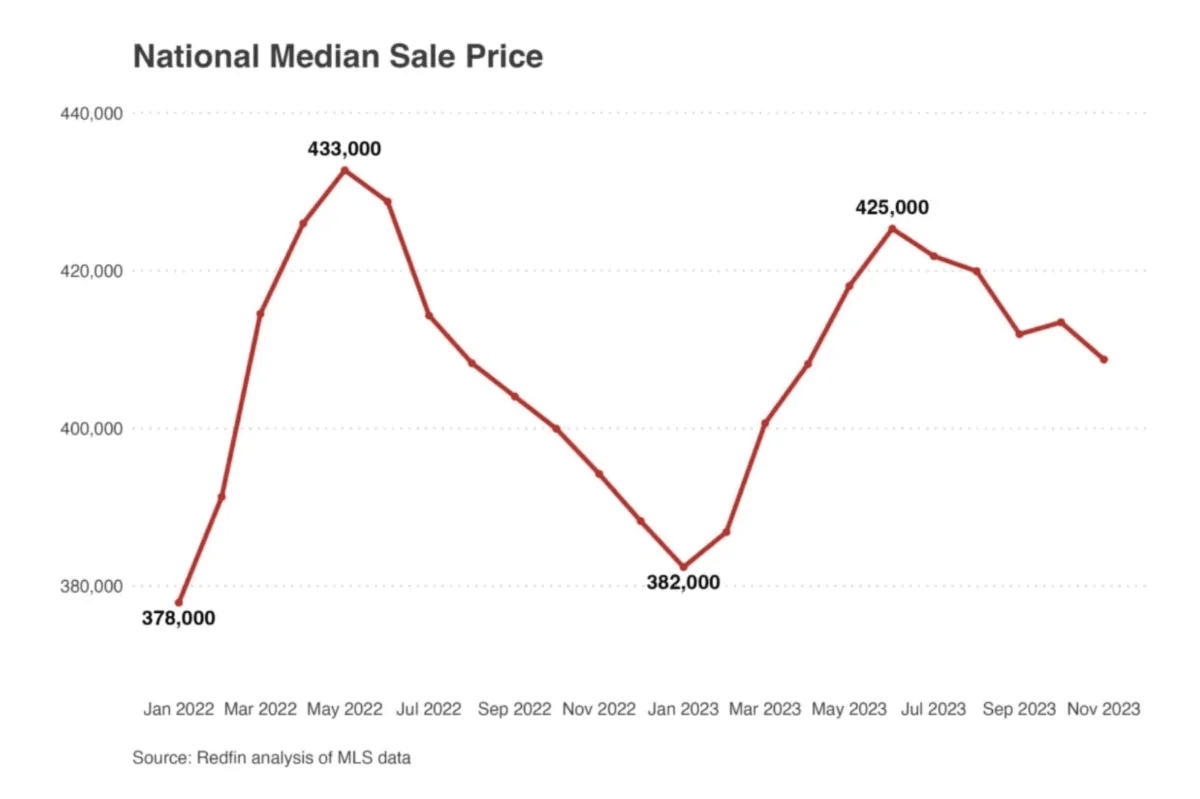

Home prices continued to increase, nearly reaching the previous year’s peak. The U.S. national median sale price peaked at $425,000 in June, just short of the record $433,000 set in 2022. More surprisingly, the national average median sale price for the year as a whole reached an all-time high, climbing from $407,000 in 2022 to $409,000 in 2023. Locally, our average sales price went from $1,793,313 in 2022 to 1,794,803 in 2023, about the same increase as the national average.

2022 – 2023 National Median Sales Price

The top six most expensive metro areas were all in California. San Francisco was the most expensive for homebuyers in 2023, still the most expensive metro in the country with a median sale price of $1,446,000.

Rent prices remained historically high. The peak median U.S. rent matched the previous year’s peak at $2,050, but by the end of the year, rents saw the first significant decrease of 2.1% credited to new apartment construction and fewer new households being formed due to affordability. Nationally, rent now takes up more than 30% of the renter’s average income.

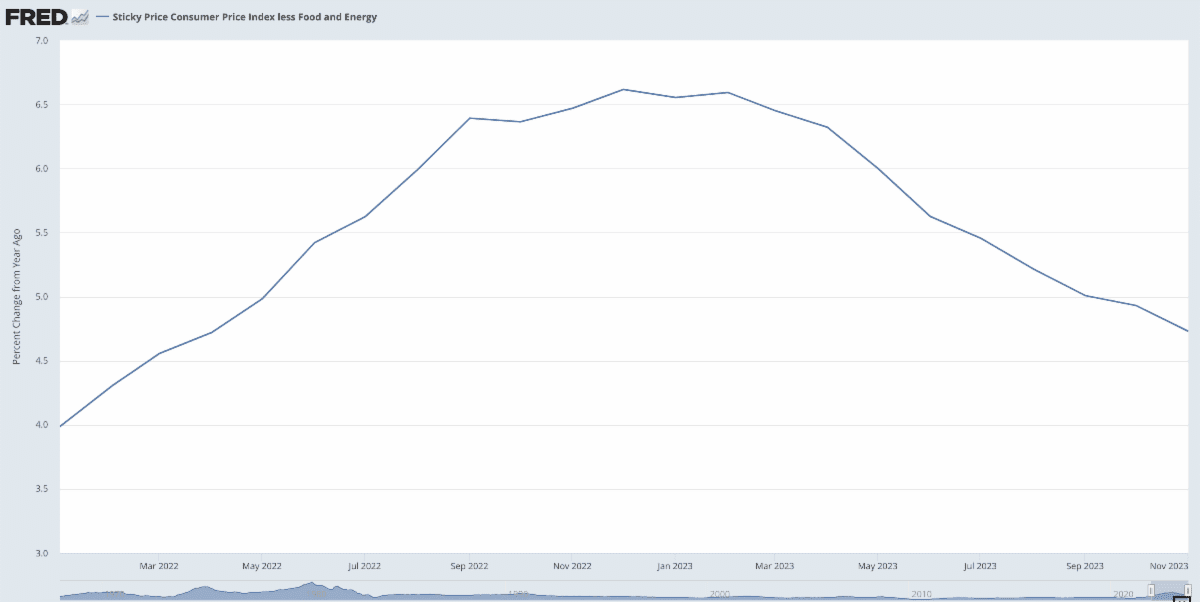

2022 – 2023 Inflation Rates

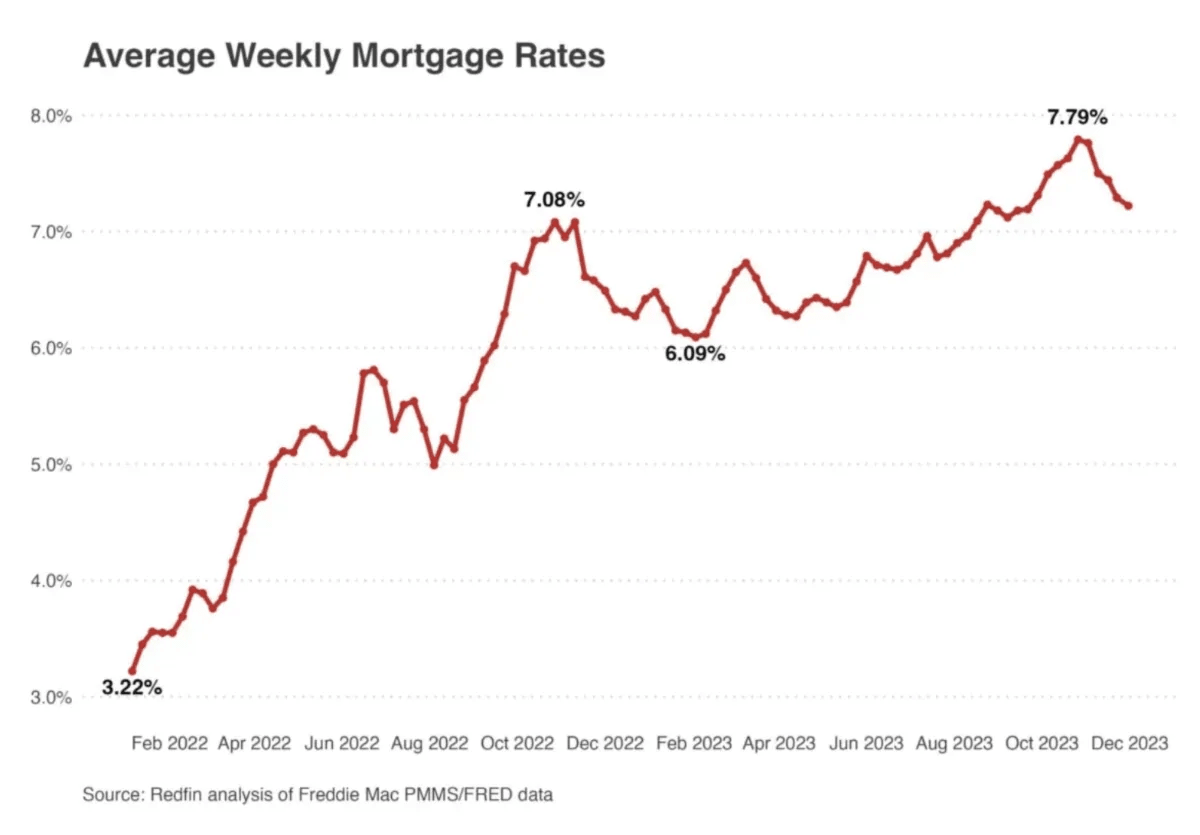

In 2023, the real estate market was most influenced by skyrocketing mortgage rates. Rates surpassed 8% for the first time since 2000 driven by record inflation, pricing many buyers and sellers out of the market. This led to home sales dropping 18% nationally and 10% locally reaching new record lows.

The average monthly mortgage payment grew over twice as fast as wages (12.6% compared to 5.2% nationally). As inflation eased mortgage rates decreased towards the end of the year. Mortgage rates are expected to continue to decrease due to the projected drop in interest rates by mid-2024.

2022 – 2023 Weekly Mortgage Rates

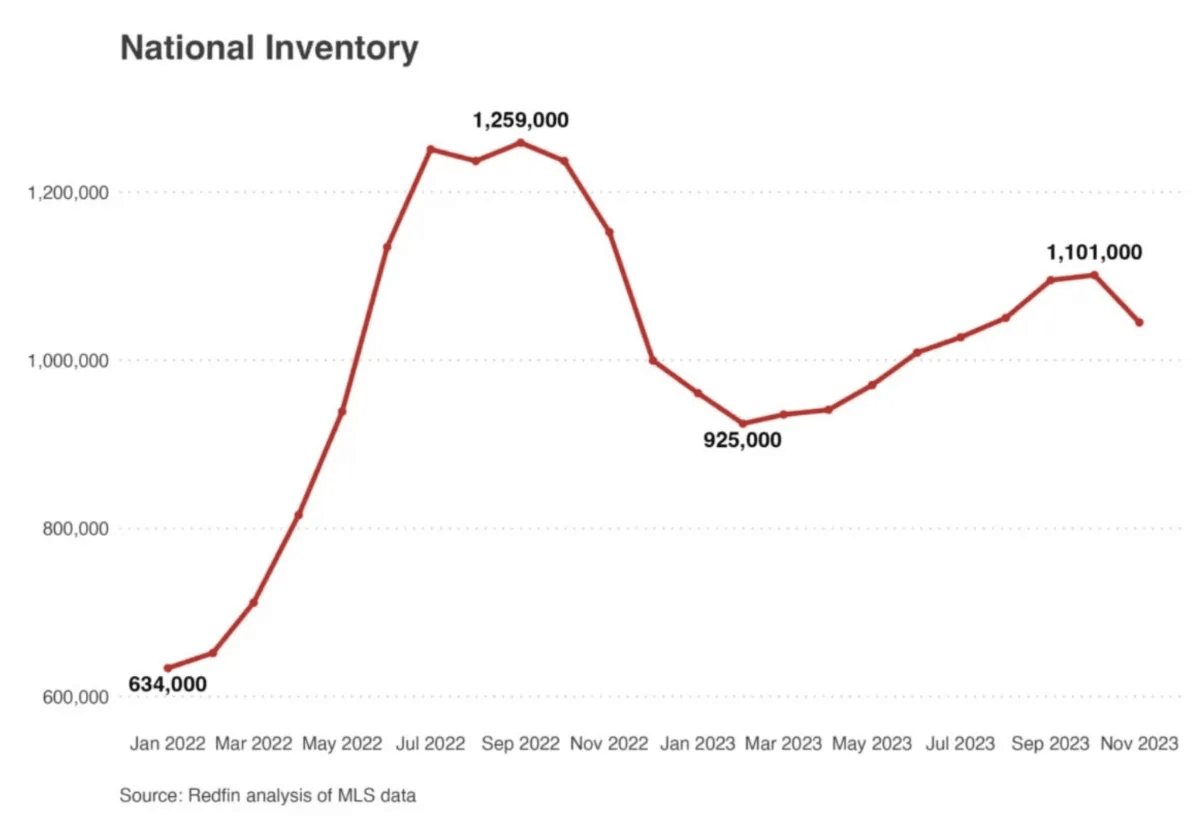

Low housing inventory continues the trend from previous years. The monthly average of homes listed for sale barely shifted from last year, at approximately 1.015 million, a 0.1% decrease. There were just 5.4 million new listings in 2023, the lowest level on record a 16.4% drop from 2022. Many potential sellers are choosing to stay in their current homes due to nearly a quarter of all homeowners being locked in at interest rates below 3%, and about 90% having rates below 6%.

2022 – 2023 National Housing Inventory

Record mortgage rates, high inflation, and persistently high housing and rental prices resulted in a difficult year in real estate. The good news is that the majority of predictions for 2024 are for mortgage rates to continue to drop, housing prices to come down a bit, and an increase in inventory so an overall better outlook for the housing market.