The market has experienced a much needed cooling off over the past couple months. The most common question we have seen lately is definitely “What is going to happen to the housing market and will we see a crash anytime soon?” Here are some key market indicators, still pointing to a strong market, that we track weekly…

Locally, we are at an absorption rate of 20%, indicating a seller’s market as inventory continues to be low. Active inventory nationwide is still 43% lower than it was in 2019.

Redfin’s demand index, which measures requests for home tours and other home-buying services, showed that recent demand was up 18% since June. We have definitely been seeing more action here at the lake.

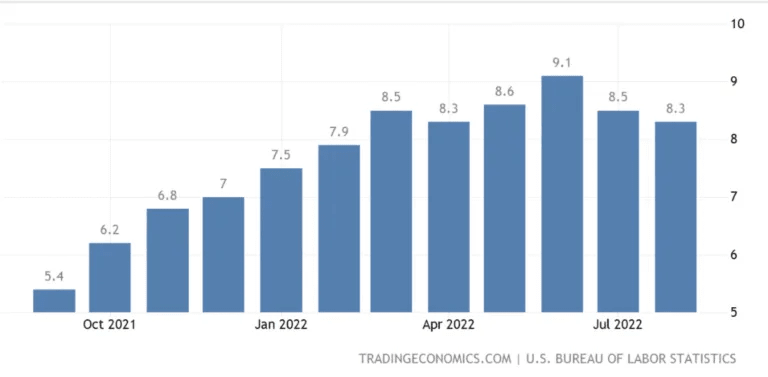

The annual inflation rate in the U.S. decreased for a second straight month to 8.3% in August 2022, the lowest in 4 months.

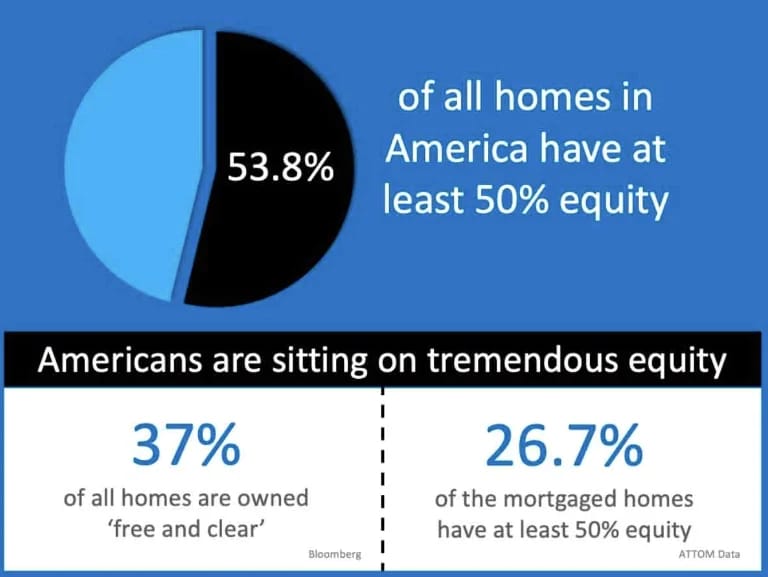

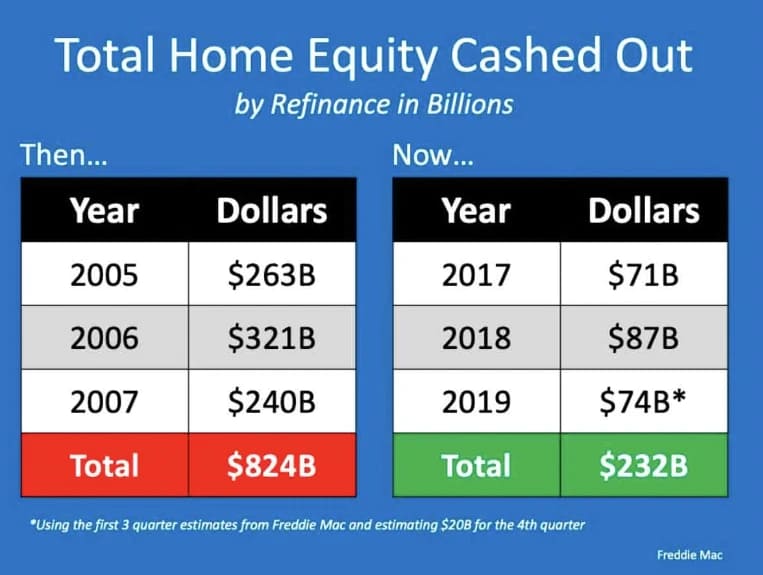

Home equity in the United States is at an all-time high, with the average mortgage holder now owning $185,000 in accessible home equity. Today, 53.8% of homes across the country have at least 50% equity.

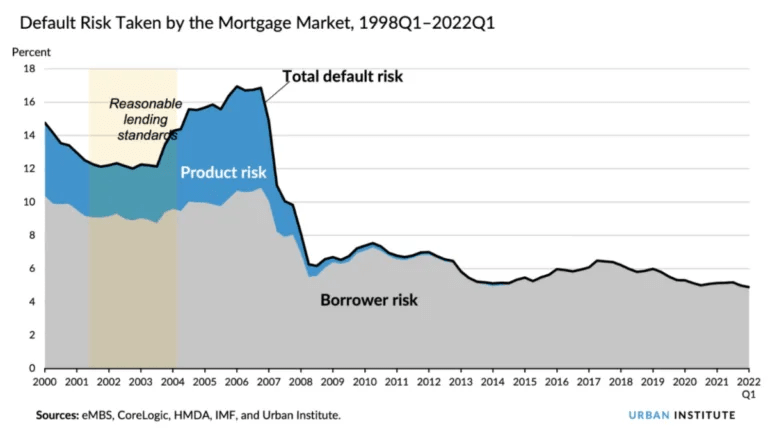

The Mortgage Bankers Association’s Mortgage Credit Availability Index is a measure that gauges the level of difficulty to secure a loan. It takes into account several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.) from over 95 lenders/investors. The higher the index, the easier it is to get a loan; the lower the index, the harder. Today we are at an all-time low meaning it is more difficult than ever before to get financing. This equates to more strength in the ability of borrowers to repay their loans.

For the 53.5 million home mortgages in America today, the average borrower credit score is at a record high 751, up from 699 in 2010.

Total mortgage debt in the US is now less than 43% of current home values, the lowest on record. Negative equity, when a borrower owes more on the loan than the home is worth, is virtually nonexistent. Compare that to over 1 in 4 borrowers who were in the negative in 2010.

United States Inflation Rate

Mortgage Credit Availability Index

Home Equity

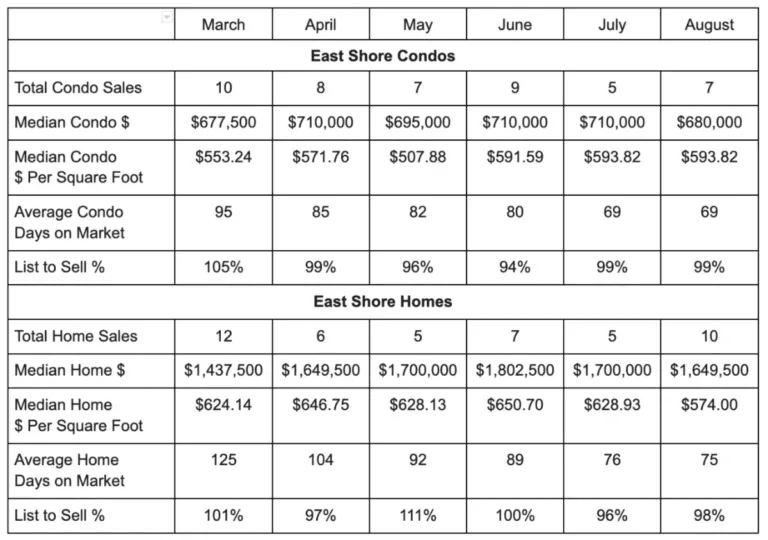

East Shore Lake Tahoe

Past 6 Months Stats

Here are the numbers from our local market this week:

We had 1 new condo and 2 new homes come onto the market this week. We currently have

32 active condos ranging from $421,500 to $3,100,000; the median condo price is $821,500. We currently have

48 active homes on the East Shore ranging from $998,000 to $64,500,000 with the median price of $3,050,000.

Here’s a year-to-date local update:

Local East Shore Lake Tahoe, Nevada Stats – All Year-to-Date

Total Sales YTD:

Condos: 70 (↓15% YOY) | Homes: 66 (↓46% YOY)

The Median Sales Price:

Condos: $702,500 (↑2% YOY) | Homes: $1,540,000 (↓1% YOY)

Number of Sales Over $1 Million:

Condos: 16 = 23% (↑10% YOY) | Homes: 54 = 81% (↑1% YOY)

Highest Priced Sale:

Condos: $5,665,500 (↓6% YOY) | Homes: $32,000,000 (↑52% YOY)

Median Price Per Square Foot:

Condos: $606.66 (↑10% YOY) | Homes: $28.37 (↑1% YOY)

Median Days on the Market:

Condos: 71 (↑37% YOY) | Homes: 75 (↑7% YOY)

List to Sell Price:

Condos: 99% (↓7% YOY) | Homes: 96% (↓33% YOY)

Price Reductions this Week:

Condos: 4 | Homes: 1

If someone you care about needs guidance or recommendations, please share our contact information as we are honored to be able to help! If you would like to receive our in-depth market update or would like an evaluation of your property’s value we would love to hear from you! We’ve put together some information below that we think you’ll find useful. If you have anything you want to share with our community please let us know so that it can be included in future newsletters.